After completing two projects in Finland, I wanted to explore something in Sweden. For now, we’ll stick with gold projects, as this remains the most interesting commodity to watch due to the latest geopolitical developments.

We’ll start with a closer look at First Nordic Metals Paubäcken project along the Swedish Gold Line. Here, the company currently has both diamond and BOT rigs in operation, and some news is expected over the coming months. I’ll start by reviewing the project’s history before delving deeper into its geology.

Premium subscribers will have access to the second part of this article, where I conduct a 3D analysis of the project and speak more openly. Additionally, exclusive members will enjoy access to Northern Explorers’ expanding 3D model database.

The Swedish Gold Line

The Paubäcken license is located along the so-called Swedish Gold Line in northern Sweden, an area with numerous gold prospects and several past-producing gold mines. The largest deposit is the Barsele project, which is currently at the development stage, with approximately 2.4 million oz in resources. Then, there is for example the former Svartliden mine (total production of 377Koz) just south of First Nordic’s Paubäcken license and the Fäboliden project (1Moz). In addition, a dozen smaller deposits have been identified throughout the belt.

Historic Exploration

Due to the proximity of the former Svartliden mine to First Nordic’s Paubäcken project, it’s no surprise that the area has undergone multiple exploration efforts over the past decades, although most focused on smaller targets within the larger license area. These efforts led to the discovery of widespread gold anomalies, a small gold prospect called Sjöliden, and several greisen-style mineralized bodies that appear, however, to be of limited economic potential.

In the second part of the article, I’ll also take a more detailed look at the Sjöliden prospect, as I believe it has important implications for First Nordic’s ongoing exploration program.

Modern Exploration

In recent years, the project has been advanced by EMX and then Gold Line Resources, which later merged with Barsele Minerals, forming First Nordic Metals — a development and exploration company that now holds most assets along the Gold Line belt, including Barsele, and controls the most prospective ground.

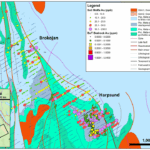

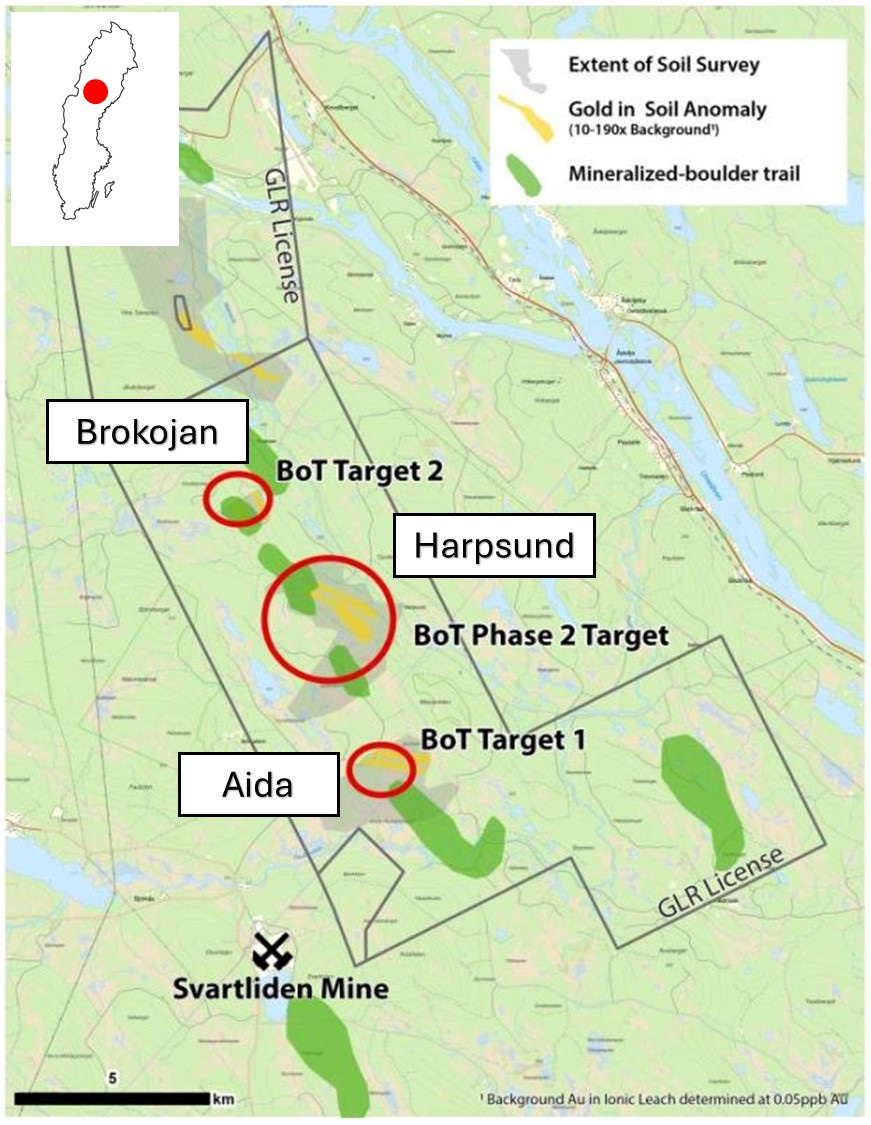

The EMX/Gold Line team initiated exploration at the Paubäcken license with an extensive soil sampling program, which defined multiple geochemical anomalies (as shown in the graphic below). Over the years, these anomalies evolved into three targets, generally referred to as Aida, Harpsund, and Brokojan.

Aida Target

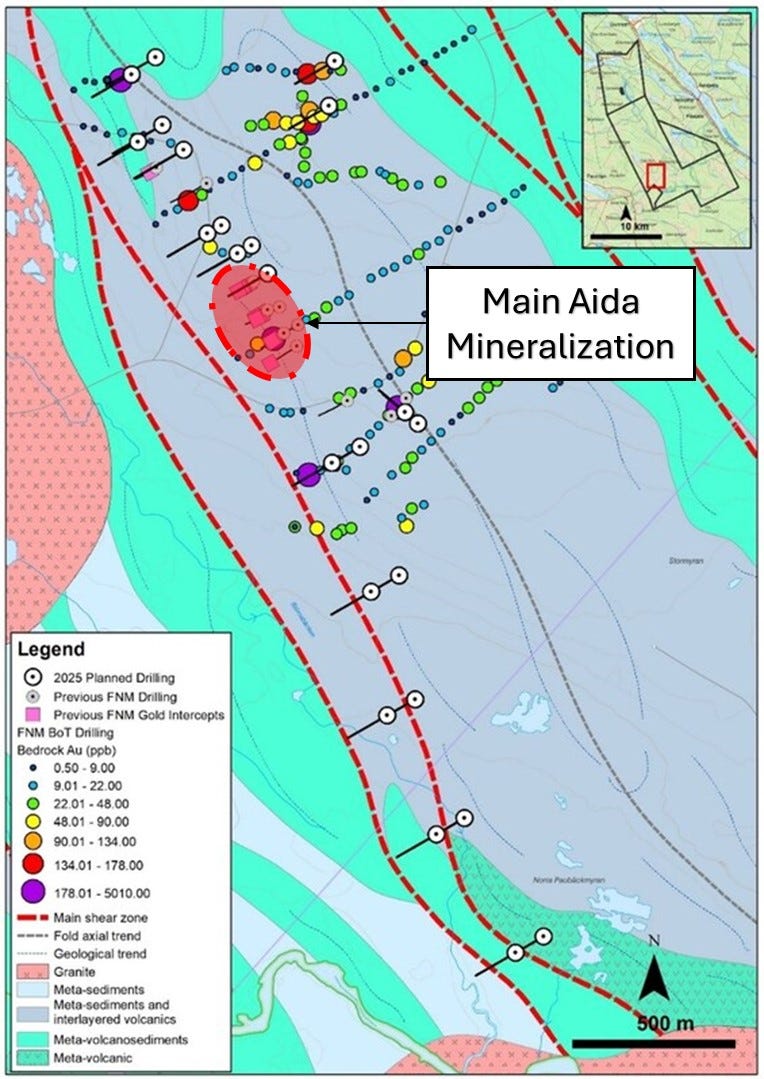

The Aida target was the first to be pursued with BOT and, eventually, diamond drilling. The latest map from First Nordic (see below) provides a good overview of the project. It shows that the company focused on some of the best BOT intercepts during its initial drilling phases. The current phase of drilling aims to test additional high-grade BOT anomalies that either remain untested or were only identified in more recent BOT campaigns.

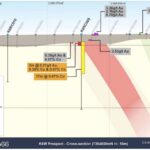

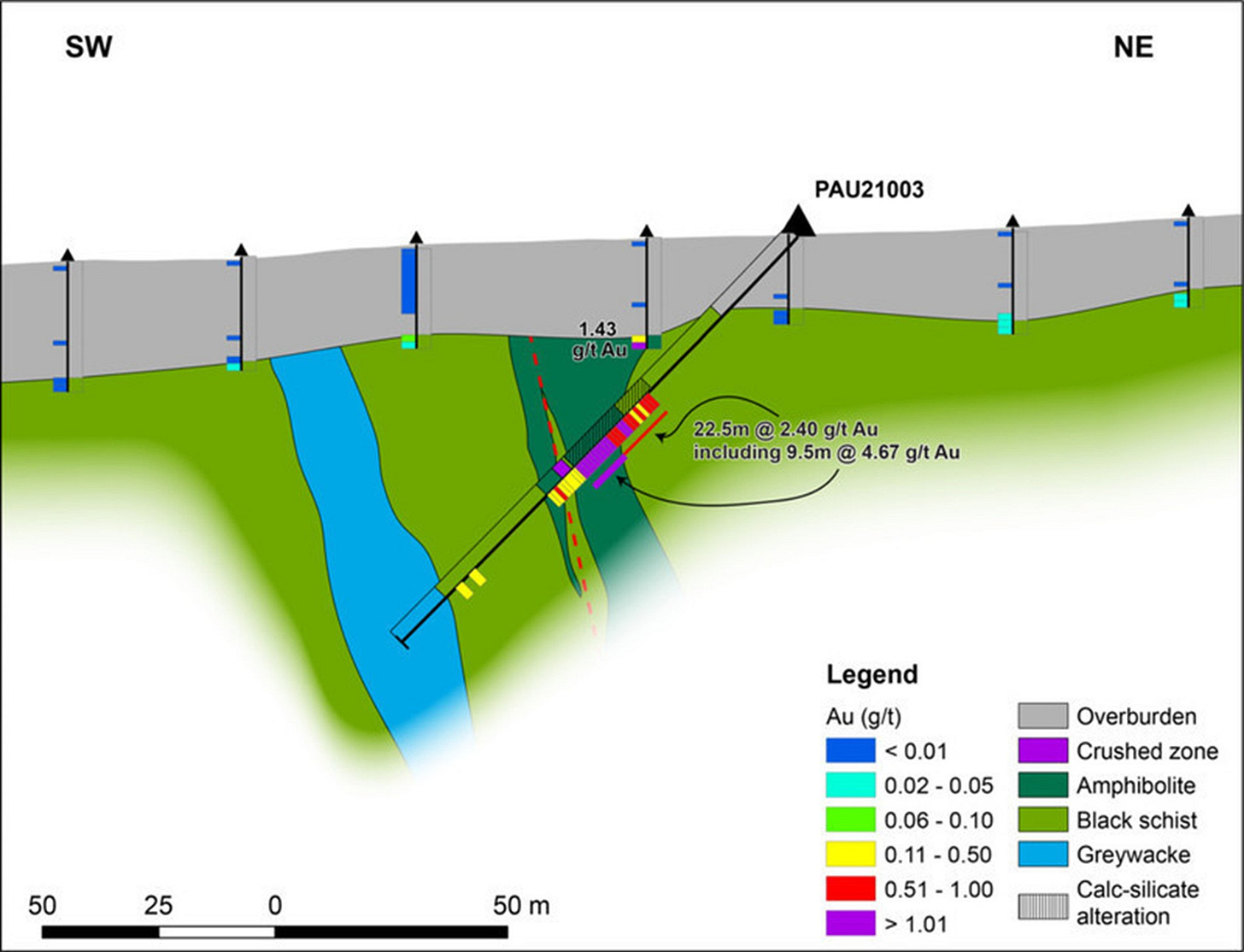

As for the initial drilling, the company’s first phase returned a very encouraging intercept in hole PAU21003, which reported 22.5m @ 2.4g/t Au, including 9.5m @ 4.6g/t Au. A follow-up drilling program consisting of six additional holes in 2022 yielded another strong intercept: 14.55m @ 2.44g/t Au, including 0.85m @ 9.6g/t Au and 1.1m @ 9.14g/t Au in drill hole 22-AID-001. This intercept represents an almost 100m step-out in depth below the initial discovery hole.

More gold has been intersected in several nearby drill holes, albeit with slightly lower grades. Overall, drilling to date has identified continuous mineralization over approximately 200-250m, with additional gold indications further to the south and north. The BOT results also suggest the potential for additional structures.

Just a few days ago, the company announced a follow-up drilling program at Aida. This program is designed to test the structural corridor an additional two km to the south, infill gaps and extend the known mineralization to the north, and evaluate an inferred parallel mineralized zone with four additional drill holes (see the graphic above for the planned collar locations).

For this drilling program, the company has budgeted approximately 5,000m, while emphasizing that it has the flexibility to significantly expand the program based on successful results.

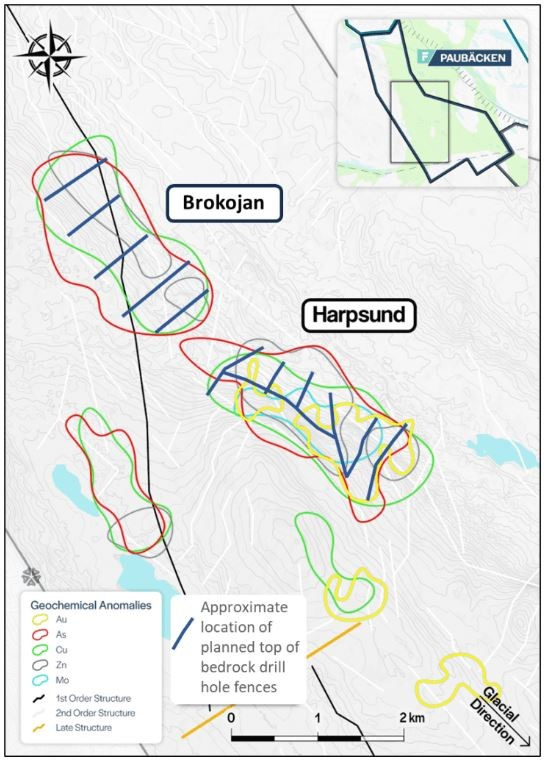

Harpsund & Brokojan

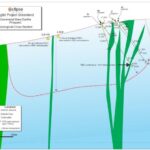

As Gold Line has primarily focused on Aida, not much has happened at Harpsund and Brokojan since the geochemical anomalies were identified. Just last week, however, the company announced the start of a large-scale Bottom of Till sampling campaign at both targets. If the program successfully confirms the till anomalies within the actual bedrock, we can expect a diamond rig to follow up swiftly.

Why did it take so long to follow up at Paubäcken?

Putting this together, I have been wondering why it took so long to follow up on an interesting discovery and promising geochemical targets. Looking at Gold Line’s historic chart, this is no longer a surprise. Although I don’t know the driving factors behind its poor performance, the collapsing share price coincided with the discoveries at Aida, likely making it difficult to raise more money for the company at that time. Thanks to First Nordic’s recent run, however, those who stuck around may have recovered at least some of their losses.

Now, let’s move on to the second part of the article, where I take a more detailed look at the project and share some insights from the analysis. If you enjoy this kind of in-depth coverage, consider becoming a premium or exclusive subscriber to access members-only content and features.