A visit to one of Sweden's next mines? 🛠️

I’ve been invited to visit Leading Edge Materials’ Norra Kärr deposit, one of Europe’s most important projects in relation to the union’s ambitious goals to reduce its raw material dependence on foreign powers. Join me for a site visit and a brief update on the project’s status.

With a resource of 110Mt @ 0.5% TREO, 1.7% ZrO2, 0.05% Nb2O2, and 65% nepheline syenite, containing more than half a million tons of rare earth elements, including significant amounts of heavy rare earths the likes of dysprosium or terbium, Norra Kärr is one of Europe’s biggest known rare earth deposits, surpassed only by the gigantic Fen complex and LKAB’s new REE resource in Kiruna (which has yet to be proven recoverable).

Located near the eastern shore of Lake Vättern (Sweden’s second-largest lake), the deposit has been known for a long time. Discovered by the Swedish Geological Survey at the beginning of the 20th century and later investigated by Boliden Mineral, it was not until the early 2000s that Tasman Metals understood the true scale and potential of the project. …Perhaps, Boliden can be forgiven for letting this one pass, as the need for rare earths was simply different back then.

Since Tasman drilled off the deposit with 119 drill holes for a total of 20,420m between 2009 and 2012, the project has been stuck in a permitting limbo, sadly underlining how Europe ended up dependent on foreign powers in the first place.

Now, with the penny slowly starting to drop (at least for most people), refined plans to develop a smaller operation with a reduced footprint, offsite processing, better resource efficiency, and the changing political climate, the project has finally a good chance to be developed.

At site 🎯

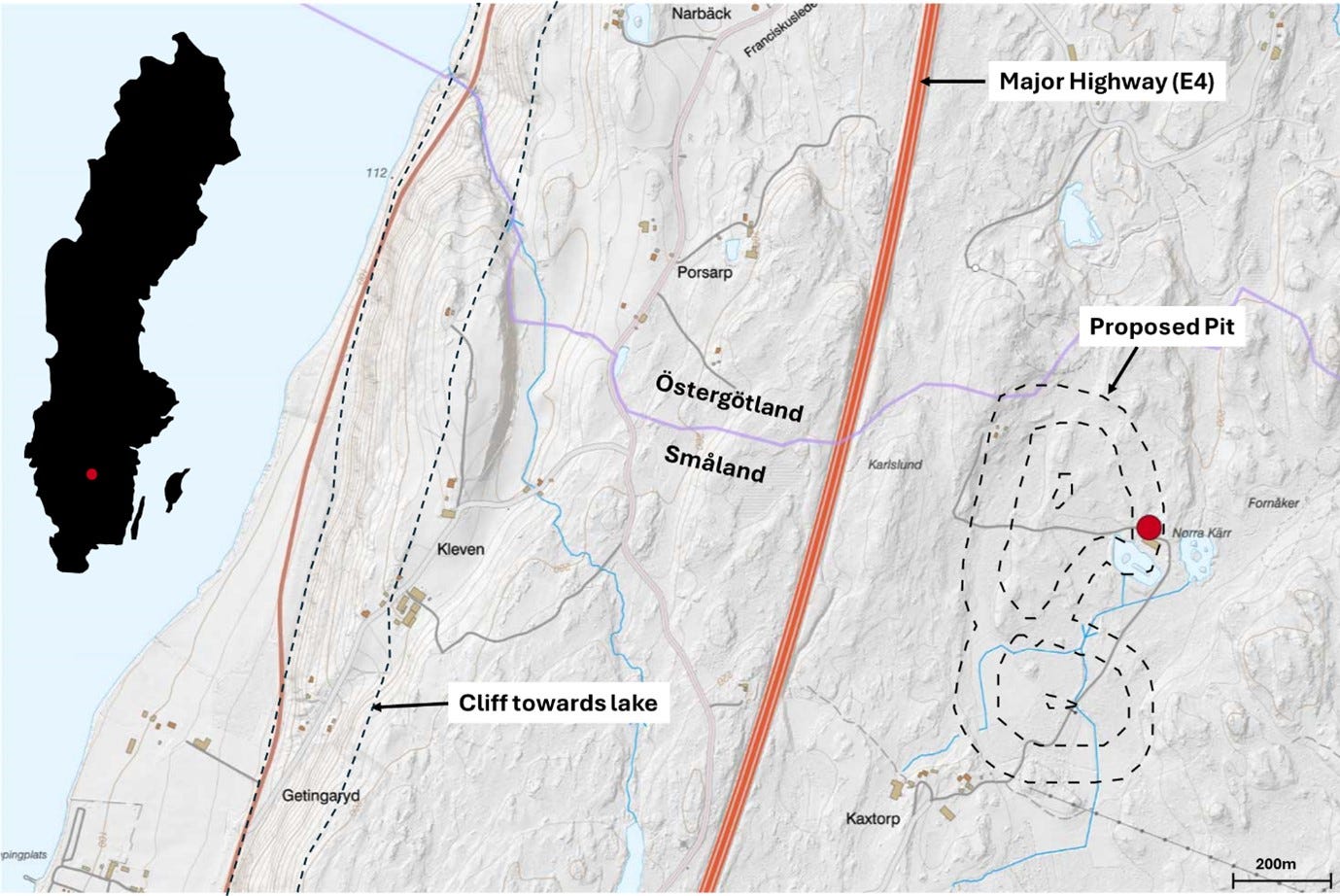

Driving to the deposit without having done much research beforehand, I was surprised to find that the deposit is a fair distance away from Lake Vättern (more than 1km) and not as some would have you believe, directly at its shore. More importantly, while the larger villages at the lake (e.g., Gränna) are located at “sea” level, the deposit itself sits at a higher elevation, separated from the lake by a locally steep rise (check topo map above for reference).

A perhaps even more important barrier towards the lake is the E4, Sweden’s main artery that connects the Arctic north of the country with the Danish islands in the south. Besides representing a physical barrier between everything mining-related and Lake Vättern, the road’s location almost on top of the deposit has been proven crucial for the updated development plans as we soon shall see.

As for large parts of Sweden, most of the deposit is covered by a variably thick soil cover, with the mineralized outcrops only locally reaching the surface. The potential mine site is covered by pasture and forest land, with a few homesteads, houses, and cabins in the surrounding, unfortunately partly overlapping with the proposed mine infrastructure.

Access to the site is excellent, which has, not surprisingly, resulted in the mineralized outcrops being battered by mineral hunters over the years (see picture below).

Geology ⛏️

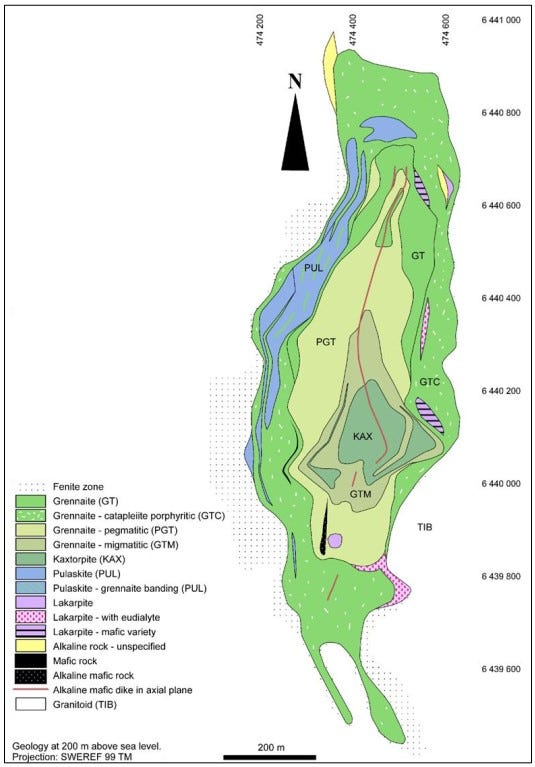

As I am a geologist, there has to be, of course …. some geology. I’ll try to keep it simple though. On a regional scale, the Norra Kärr intrusive complex sits within the so-called Trans-Scandinavian Igneous Belt (TIB) – a belt of some 1,800 million-years-old, mostly granitic intrusions stretching from southernmost Sweden to the northern parts of Norway. The Norra Kärr complex, however, is some 300 million years younger and seems to have emplaced itself within the TIB rocks by rising along a crustal-scale shear zone that cuts through large parts of southern Sweden.

Covering only around 1.3km x 450m, the Norra Kärr complex is geologically described as a peralkaline, nepheline syenite, very similar to other major REE phyric intrusions like Ilimaussaq in Greenland or the giant Lovozero complex on the Kola Peninsula.

While REEs occur throughout the nepheline-syenite complex, their highest concentrations correlate with two subunits termed pegmatitic (PGT) and migmatitic (GTM) grennaite which, together, form the main economic part of the deposit.

So where exactly do the rare earth elements sit within these rocks? Different from other REE deposits like e.g. Olserum, where the REEs sit in phosphate minerals (Monazite, Xenotime & Apatite) almost all rare earth elements at Norra Kärr occur in a complex silicate mineral called Eudialyte (Na15Ca6 (Fe,Mn,Ti,Cr,Y,REE) 3(Zr,Ti,Nb) 3Si(Si25O73) (O,OH,H2O) 3(Cl,OH)2)… looking complex indeed🙄.

Depending on the exact composition, the Eudialyte from Norra Kärr can have a pink (“polkagris”) to brownish-red color. Studies have shown that depending on hostrock subtype and eudialyte composition, the REE content in the mineral can vary from 6-10% and contain between 30% and 70% of the more valuable heavy rare earth elements. That is, however, not all the good stuff. Eudialyte also contains niobium and zirconium that can be recovered and sold as products for a variety of uses.

Refined Development Plans 📈

Following the acquisition of a major stake in the company by Swedish investor and mine developer Eric Krafft (who owns almost half the company) a few years back, Leading Edge made significant changes to the project’s design to address the opposition’s concerns.

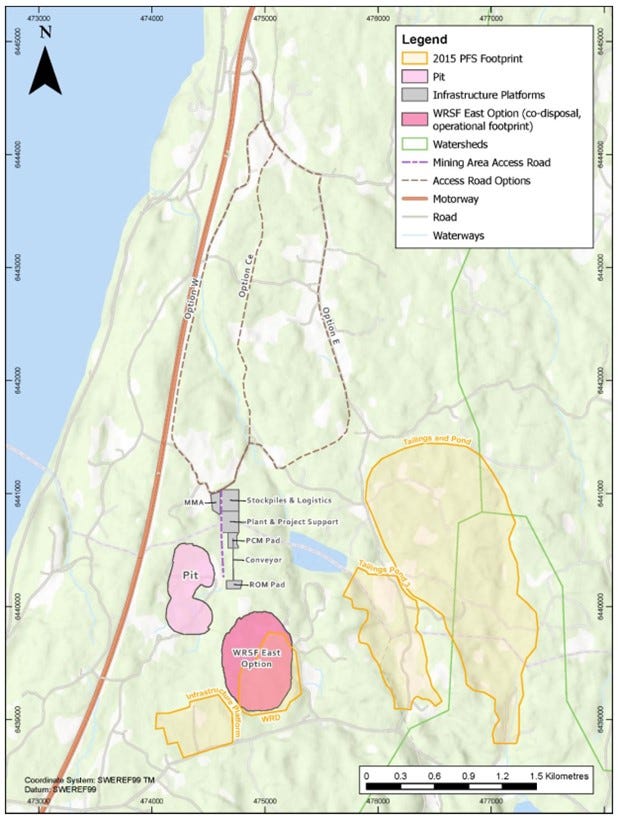

First and foremost, plans for an REE processing facility at the mine site were scrapped in favor of an off-site processing solution at an existing, brownfield industrial site (tentatively Luelå).

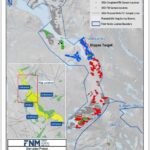

With the more controversial processing steps removed, there is no longer a need for chemical usage or a large wet-tailings facility that could potentially pose a threat to Lake Vättern. What remains at the site are facilities for crushing, milling and magnetic separation of the ore, related infrastructure and a dry tailings storage facility. This reduces the footprint of the mine and surrounding infrastructure to a fraction of the previous plans. (The graphic below compares 2015 and 2021 infrastructure design).

Following magnetic separation of the ore, the Eudialyte concentrate (containing rare earths, niobium & zirconium) will be transported to the offsite processing facilities before being sold as refined concentrates to the end customers. Based on the 2021 PEA, the mine is planned on a total of 30Mt, a fraction of the complete resource. Over a 26-year mine life, this equates to approximately 1.15Mt of ore, resulting in around 105Kt Eudialyte concentrate, for some 5000-6000t rare earths annually.

Different from the 2015 PEA, the company now also plans to turn the nepheline syenite, which would have previously ended on the waste pile, into a set of different products to be sold at the mine (for example as a flux for ceramics, to lower melting temperatures in glass or as a functional filler in polymers and coatings). This will significantly increase the resource efficiency of the mine (now some 70% of the ore is used) and drastically reduce the size of the dry tailings stored at site.

Going forward, the company aims to carry out additional studies on the commercial viability of the aegirine concentrate that is currently anticipated to make up a big part of the dry tailings storage. If an industrial use for this material can be found, the resource efficiency might go up to almost 100%, thereby eliminating the need for any kind of tailings facility, as a stripping ratio of 0.3 should easily allow backfilling all the waste rock.

Perhaps the only downside to the new development plans is the increase in truck traffic needed to transport the Eudialyte concentrate and the nepheline-syenite products. However, thanks to the nearby E4, the trucks should blend into the traffic traveling up and down the country rather easily.

After having seen the site itself and understanding the new development plans, I have a hard time seeing any more fact-based opposition arising against the project. Of course, anyone directly affected by the development of the transport route between the pit and the E4 (see graphic below), might understandably have objections to the project, as they will either have to move or get used to dozens of trucks passing by daily. There are, however, almost no projects of that size with such an overall limited effect on local stakeholders and low contamination risk (remember it’s not a sulfide mine), when compared with the benefits they can bring to society as a whole.

Timeline 🕒

As mentioned previously, the project has been held up through permitting delays and political power plays for many years. Originally granted an exploitation license by the mining inspectorate in 2013, the decision was reverted to application status following an appeal to the Supreme Administrative Court in 2016. In 2021, the mine inspector rejected the application, on grounds that the company did not acquire a Natura 2000 permit before starting its mining lease application.

Following a recent ruling that a Natura 2000 permit no longer is a prerequisite for the granting of a mining permit and the design of the new development plans outlined in the 2021 PEA, Leading Edge is currently preparing a new mining concession and environmental permit application (the latter including the Natura 2000 permit).

Perhaps even more important for the project’s future is the recent adoption of the European Union’s Critical Raw Material Act. The act that aims to reduce the union’s dependence on foreign-sourced critical raw materials contains a section on so-called strategic projects that could become a game changer for Norra Kärr.

If a project is designated a strategic project, the member states are automatically obliged to follow a streamlined and, more importantly, timely limited permitting process. In concrete terms, this means that all permits needed for mining operations must be received within 27 months after the strategic project’s designation. In addition to a clear timeline, strategic projects will also benefit from a sole person of contact who shall guide the company through the permitting process on a national level.

As one of the largest and most advanced REE projects in the European Union, Norra Kärr is, together with Boliden’s Laver deposit (which could increase the Swedish copper production by some 30%) and, in my opinion, the uranium in the Alum shales (which could supply all of Europe for decades if not more) probably Sweden’s most strategic, undeveloped commodity asset.

Not surprisingly, Leading Edge Materials recently advised it is applying for Norra Kärr to be designated a strategic project in the first round of applications. If selected in Q4 2024, the project would finally have a clear pathway to production, ending years of uncertainty and critically reducing the union’s dependence on REE imports from other nations.

/TheNorthernExplorer