In this article, I’ll take a look at one of the latest frontiers of exploration, discuss its geology, highlight the most important companies and projects and consider what it could mean for Sweden

When compiling the weekly exploration newsletter a few weeks back I came across a topic that was completely new to me. Instead of conducting some brief research, I ended up doing a deep dive into the fascinating world of geological hydrogen. Don’t know what that is? Don’t worry; you’re probably not alone. Join me, as I explore this new frontier of exploration.

H2

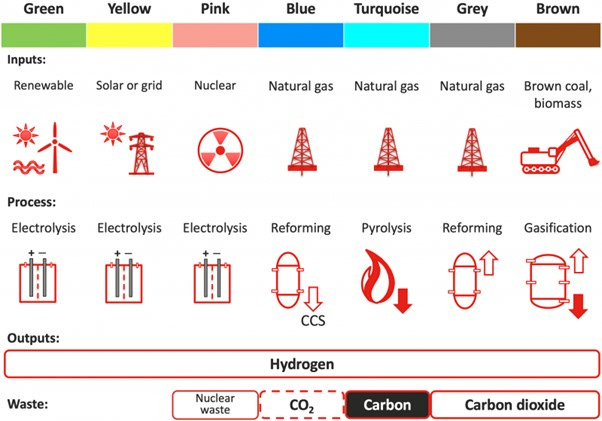

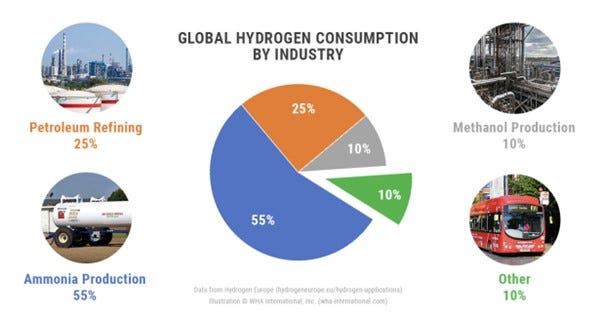

Hydrogen. The most abundant element in the universe. Today, we mostly use it to produce ammonia (fertilizer) and other chemical products that are essential in our everyday lives. The hydrogen we consume can be produced through a range of different processes, the most common of which are based on the synthesis from fossil fuels. Over the years, this has resulted in a ridiculous rainbow color scheme to describe the different ways to generate hydrogen – see below.

Today, the world needs around 100Mt of hydrogen each year, a number that is expected to grow several times to some 500Mt over the next decades.

While its use in fertilizer products and the petrochemical industry will continue to play an important role, the projected increase in hydrogen demand is mostly related to its intended use as fuel in combustion engines or as an alternative to coking coal in the steel industry.

Remember that Toyota, the world’s largest car manufacturer (in terms of produced automobiles) is still placing its bets on hydrogen-fueled vehicles over battery-powered alternatives. You probably also know of Sweden’s plans to transform its steel industry, replacing coking coal with hydrogen (“green steel”).

As H2 production from fossil fuels produces an excessive amount of CO2, the world’s most hated molecule, a clear shift towards green hydrogen is underway. Thanks to its production via electrolysis using renewable energies, green hydrogen is an emission-free energy source. It is, however, quite energy-intensive and has, therefore been more costly to produce than the hydrocarbon-derived alternatives. The graphic below illustrates how the color of hydrogen, i.e. its synthetization method, affects the price.

Is geological hydrogen an even better solution? ⛏️

Although advances in both electrolyzer and renewable energy technologies are expected to bring down the price of green hydrogen, there exists another alternative that has not even made it on most of the rainbow charts.

Depending on where you look it’s described as geological, natural, white, or gold hydrogen. In the end, it all means the same: hydrogen naturally occurring in the subsurface of our planet. Natural hydrogen has the potential to be produced extremely cheaply from a potentially regenerating source while emitting almost zero CO2.

While the existence of geological hydrogen has long been known, it was not until 1987 that drilling in Mali intersected almost pure hydrogen, albeit accidentally. While the discovery in Mali eventually led to the establishment of the worlds first hydrogen well that today supplies a nearby village with electricity, it has long been viewed as a small-scale curiosity. Over the last couple of years, this view has, however, drastically changed, as more and more hydrogen is discovered all over the world. Not least a large discovery of possibly up to 250Mt of hydrogen in northeastern France made a lot of people in the industry and science understand that this gas is, in fact, much more abundant than previously assumed.

How does it form? 🔄

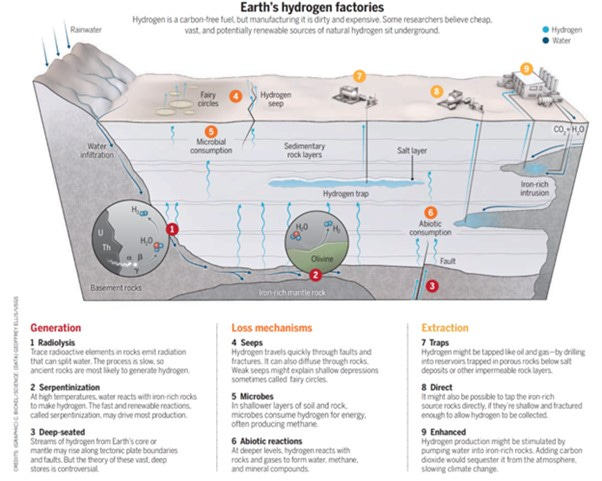

As it wasn’t until recently that geological hydrogen became of interest, the research on this subject is still in its infancy. Although more mechanisms are likely to exist, three main formation mechanisms are included in most models. Radiolysis. Deep-Seated. Serpentinization.

Formation through radiolysis is a simple process where radiation can split water molecules, producing H2. According to the deep-seated model, hydrogen is inferred to rise along crustal-scale deformation zones that tap into vast reservoirs in the mantle or the core. Serpentinization essentially describes the process of hydrogen generation due to the interaction of iron-rich rocks with water.

Of those three, the latter is the best understood, appears to drive most hydrogen production, and is the current focus of multiple exploration campaigns.

In short, serpentinization represents a set of reactions that transform ultramafic rocks into serpentine under the influx of water and at elevated temperatures (I highlighted the most important of those reactions below). Under the presence of water, the iron in fayalite oxidizes while the hydrogen in the water is reduced to form geological hydrogen.

3 Fe2SiO4 + 2 H2O → Fe3O4 + 3 SiO2+ 2 H2

As a light gas and tiny molecule, hydrogen then rises along fissures, pores, and cracks to the surface, where it, more often than not, escapes into the atmosphere. While a certain part of the formed hydrogen is almost certainly going to escape, it can react again with other gases, rocks, or microbes before it reaches the surface. Another possibility is that the rising gas encounters a trap, such as salt or other impermeable layers, leading to the formation of reservoirs, similar to what is known from the oil and gas industry. It is these reservoirs that are the focus of this newly emerging industry, with the first wells recently being drilled or planned all over the world.

There exists, however, also the possibility to tap the iron-rich lithologies directly and extract the hydrogen from its source. In theory, it should also be possible to induce the hydrogen-generating reaction by introducing water in iron-rich rocks – something that is generally referred to as stimulated or enhanced hydrogen.

What makes the geological hydrogen story even more interesting is the fact that reaction to form hydrogen is a very fast process, taking place in a matter of days. This means that even if tapped, the reservoir should, in theory, refill within days, thus representing a renewable source of clean energy.

To summarize, we can expect to find geological hydrogen rising along deep-seated structures, associated with radioactive decay or with iron-rich lithologies in contact with water.

Global players so far? 🌍🏆

So how is the global geological hydrogen industry looking like these days? Well, it’s in its infancy and there is only one active producer – Hydroma, the company that re-discovered and developed the hydrogen occurrence in Mali. Apart from that there exist a bunch of private companies, albeit some with significant financial backing. On the public front, I could only find a handful of companies, mostly listed in Australia or Canada.

With regards to stimulated hydrogen, a company called Eden Geo Power is about to start a trial on stimulated geological hydrogen in the ophiolites of Oman.

Private companies 💼

Hydroma: The only company currently producing geological hydrogen in a pilot project that supplies a local village with clean hydrogen energy.

Helios Aragon: A company that is developing the Monzon project in Northern Spain. A 12 million dollar well is planned to be drilled in H2 2024 and the company plans to be in production before the end of the decade. Additional plans to repeat the same process elsewhere in Europe exist.

Koloma: This is an interesting one. Recently got 100s of millions in funding from the likes of Gates etc. The company has projects in the Midwest.

Natural Hydrogen Energy: First company to drill for hydrogen and associated helium in the Americas in 2019. Currently working towards commercial production.

Public companies 🏛️

La Francaise de l Energie (EPA: FDE): A French energy company that aims to supply local communities with energy from variable, nearby sources. The company was part of the discovery of a large hydrogen reservoir in eastern France and controls a large exploration block over the field.

Gold Hydrogen (ASX: GHY): The biggest of all the public hydrogen explores with an almost 100M AUD market cap. The company is a first mover with a significant land package in southern Australia where historic wells indicated the presence of geological hydrogen. Drilling of new wells is planned shortly.

Hyterra (ASX: HYT): The first company to list on the ASX with a focus on white hydrogen. The company is preparing to drill two wells at its Nemaha project in Kansas, scheduled to commence in September 2024. The site of their projects is close to existing ammonia manufacturers and petrochemical plants.

Quebec Innovative Materials Corp (CSE: QIMC): Quebec-based junior, exploring its early-stage Ville Marie H & He project.

Longhorn Exploration (TSX-V: LEX): Small company that recently acquired the rights to a Kansas hydrogen project in the vicinity of the bigger players. Currently conducting some initial rounds of exploration.

Buru Energy Limited (ASX:BRU): An ASX-listed oil and gas company. 100% owners of 2H-Resources, a private company holding significant exploration license applications in South Australia.

Bluejay Mining (AIM:JAY): This is the company that made me look into all this. Following a recent strategy update, Bluejay started to look into the broadening of its portfolio with a step into the industrial gas and hydrocarbon world. A proposed acquisition of White Flame Energy Ltd would give the company an extensive portfolio in Greenland with good prospectivity for H2. In addition, the company recently reported the previously unrecognized potential of geological hydrogen at its Outokumpu belt properties in eastern Finland.

Implications for Sweden 🏭

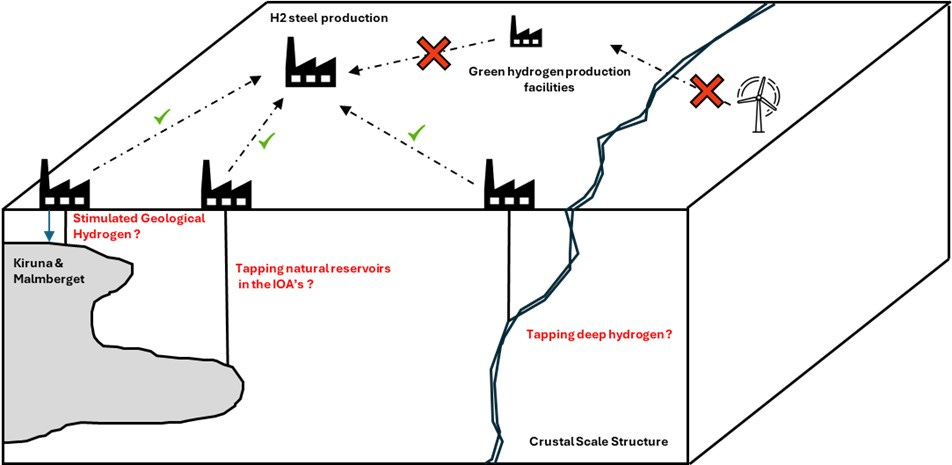

While compiling all this I could not help but see the potential implications for Sweden’s heavy industry. Big money is currently being deployed to transform the country’s steel production into a CO2-free endeavor relying on H2 instead of coking coal. This is, however, one of the main reasons why the Swedish electricity demand is expected to more than double over the next decades. If green hydrogen fails to be produced at low prices, some of Sweden’s biggest industries are put at risk.

This could be mitigated if there were some large accumulations of geological hydrogen to be found near the planned production sites (one of the disadvantages of hydrogen is that it’s difficult to transport because it’s so light and reactive – hence, you want to use it as close to source as possible). So, could geological hydrogen be found in northern Sweden? I believe the chances are quite high.

Firstly, the northernmost part of the country is known to host several large, crustal-scale shear zones, some of which are also closely related to the area’s biggest iron operations and should be tested for their hydrogen potential.

Secondly, and in my opinion, more importantly, the iron mines themselves might prove to be rather interesting. As discussed above, H2 is produced through the interaction of water with iron-rich lithologies like peridotites (Fe2+ is needed). That begs the question if the same process could be expected in some of the largest accumulations of iron minerals on the planet – the iron ore bodies themselves.

While there seems to be almost no research into this direction, I found a paper that indicates a certain potential of banded iron formation for the formation of geological hydrogen (Geymond et al., 2023). Although LKAB’s massive iron ores of northern Sweden are not classified as BIFs (currently they are mostly referred to as Apatite Iron Ores), they should be investigated immediately for their hydrogen potential as they represent essentially the same – massive accumulations of Fe-minerals.

Not only is there a chance that they are leaking hydrogen and constantly producing it, but the existing mining infrastructure could also be used to produce hydrogen by deliberately inducing water into the ore bodies, as proposed in the stimulated geological hydrogen model.

I would expect that the mines are aware of the gases leaking from their operations, but from what I read, it is not so common to analyze for hydrogen. So, if this is all new for the companies up north, the following questions should be raised urgently before more money is invested in the development of green hydrogen production, while a much cheaper alternative might be just around the corner.

Have we explored for geological hydrogen in northern Sweden? Do we have good control over the gases coming out of our iron mines? Are we sure that there is no hydrogen in significant amounts leaking out? Can we turn the iron mines into hydrogen-generating powerhouses?

I would be very interested to hear from someone at these big companies or the research institutions up north if any of this has been done.

From a legal point of view, there exists currently a ban on gas extraction in Sweden. I would suggest that our lobby organizations attack that issue immediately so that extraction is allowed, at least if H2 is the dominant gas.

Hope you liked this excurse into a rather unusual topic.

/TheNorthernExplorer