As we approach the end of the year, I thought it might be interesting to share a little recap of the major headlines that dominated our industry in 2024. It has been an exciting year for the Nordic mining industry, with new discoveries being made, significant deals being negotiated, and several new mines opening.

Mergers & Acquisitions 💰🤝

Starting with a look at the mergers, acquisitions, and deals that took place over the last 12 months, we should begin with the landmark deal Kingsrose Mining managed to secure from BHP. The deal is a direct result of BHP’s Xplor program, in which Kingsrose has been one of the very first participants. Valued at tens of millions of USD, the deal gives BHP access to some of the most prospective ground in the world – Finnmark. It will be interesting to see if other majors follow suit with similar valuations or if this remains an outlier.

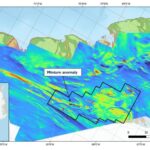

As Finnmark is as reindeer-dense as it gets, this part of Norway has historically not been an easy place to explore. However, the Kingsrose-BHP joint venture (JV) has invested significant time and resources in making this work and has recently received its first drilling permits to test the Porsanger magmatic nickel sulfide PGE prospect.

Moving over to Sweden, where two of the industry’s most successful veterans managed to bring a new copper producer all the way from southern Europe to northern Sweden. The deal between Mineral Prospektering i Sverige (MPS) and Atalaya Mining centers on MPS’s VMS projects in the central Skellefte Belt and around Boliden’s Rockliden deposit. With a total project valuation of around $30 million USD and some skilled geologists at work, Boliden might have to get used to a new player in their backyard…

However, Boliden was not lazy this year either. Only a few weeks ago, the company announced that they had acquired the Zinkgruvan and Neves Corvo mines from Lundin Mining for around $1.45 billion USD. Following the deal, Boliden will add approximately 200,000 tons of zinc and, more importantly, around 30,000 tons of copper to its annual production.

When talking about zinc (which no one seems to do these days…), I found it noteworthy that the Citronen Fjord project in northern Greenland, one of the world’s largest undeveloped zinc resources, has just changed hands for a mere AUD 1.4 million from Ironbark to a Dubai-based company. I guess that goes to show that project location and existing infrastructure should always be considered.

Discoveries 🗺️⛏️

Looking back through my weekly summaries, I wanted to take a brief look at some of the (potential) new greenfield discoveries emerging in the Nordics.

While 2024 has seen some success in brownfield exploration, such as Mandalay’s work around Björkdal, the number of actual greenfield discoveries with clear indications of economic mineralization has been rather low.

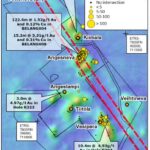

One of the exploration campaigns I would like to highlight is European Green Transition’s work at the Olserum deposit. After an IPO at the beginning of the year, the company’s geological team conducted excellent fieldwork, which resulted in a new geological model that was proven correct in subsequent channel sampling and drilling campaigns. To date, the company’s work around the Olserum deposit has led to the discovery of multiple zones of high-grade REE mineralization and the recognition of a district-scale REE opportunity in southern Sweden.

As the company’s leadership seems to have little interest in exploration, despite having one of the best teams around, I hope to see a strategic acquisition of the assets during ’25, ensuring that the momentum in this newly developing district can be maintained.

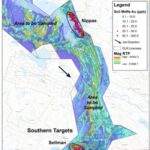

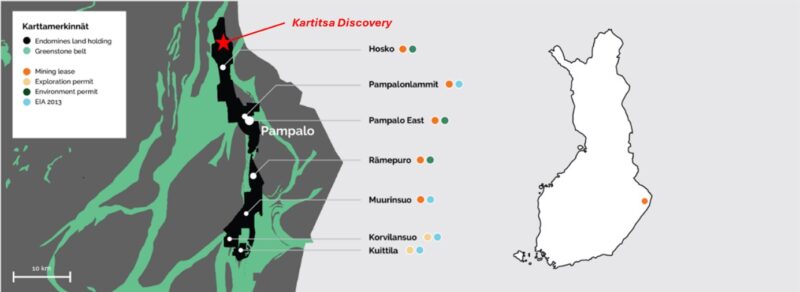

While Olserum is certainly an interesting project to follow, I would argue that the best find of 2024 was made in eastern Finland by Endomines’s geological team at the Kartitsa prospect, located at the northern end of the Karelian Gold Line, only a few kilometers north of the company’s Pampalo mine and mill. Even though initial gold mineralization at the prospect was already discovered in 2022, it wasn’t until this year that the company started to hit the sweet spot and define a continuous zone of locally high-grade mineralization further north of the initial discovery. While the size of the discovery is yet unclear, there is a good chance it may prove to be economic due to the company’s existing infrastructure and presence along the belt.

As I’m currently working on a deeper analysis of this prospect and the company itself, I will leave it at this for now. The analysis should be ready in one or two weeks, depending on how fast my guides on mineral exploration come along. (If you haven’t seen them yet, here are the ones for Norway and Sweden.)

Commissioning of Mines & Significant Milestones ⛏️🏭

When it comes to commissioning new mines or companies securing important permits, this year has been busy too. In Sweden, Botnia Exploration successfully opened its Fäbodtjärn gold mine, representing Sweden’s first new mine in a few years. Meanwhile, Talga Group and Viscaria (formerly Copperstone) were able to secure important permits required for the (re)-opening of their operations, which are expected to come online within the next few years.

In Norway, an important legal question regarding the ownership of landowner’s minerals was finally (mostly) resolved, resulting in the Engebø Ti-Garnet project advancing toward construction and first production.

The year also proved successful for Greenland’s mining industry, where the re-opening of the Nalunaq gold mine marked the commissioning of the first metal mine in years for the Nordic nation.

With that, I’m wishing you all a great start to a successful new year!

TheNorthernExplorer